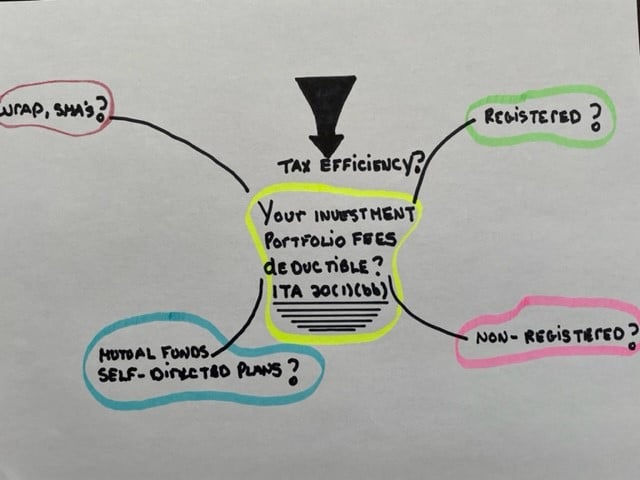

Your Investment Portfolio Fees: Deductible?

Fees paid to an investment advisor, counselor, mutual fund representative, or financial planner may be deductible. This deductibility increases the efficiency of your portfolio’s returns. However, fee deductibility is poorly understood in the financial services industry. Stay tuned for the following rules, as they will guide you towards the tax optimization of your portfolio.

First, fees must be paid to a person who is a financial professional. This person must devote themself primarily to providing advice on purchasing and selling securities and administering or managing an investment portfolio. You can only deduct fees; CRA will accept no commissions.

In addition, the concept of fees is defined in the tax law, and it is also cultivated as the following definition: « any means, which makes it possible to complete an exchange of services, directly or indirectly, received or to be accepted, to complete a series of specific operations. »

In other words, the management expense ratio (MER), which is the cost of managing your investment portfolio, is eligible for this deduction.

Registered plans

Registered plans are a tripartite contract between you, your financial institution, and the government. Fees that will be paid in a registered plan, including, but not limited to, RRSP, TFSA, RRIF, group RRSPs, and RPPs, are not deductible on your tax return.

Non-registered plans

Fees can be paid in several ways, and the tax impact will vary depending on the type of financial product you support in your account:

You use mutual funds.

Mutual funds are essentially investment trusts. In addition, mutual funds can be structured within a defined corporation, and they are called: corporate class funds. The trust, or corporation, manages its investments, and investors acquire units of interest within the specific business structure. These businesses are distinct, responsible, and in charge of the portfolio make-up and their particular investment policy statement. Unfortunately, you cannot deduct your fees using mutual funds or corporate class.

With that in mind, Michelle Munro, Senior Director, Retirement and Tax Research for Fidelity, explains why: « you don’t pay the fees directly, but instead, you pay a management expense ratio (MER). Mutual funds deduct the MER within the trust structure and make distributions after this deduction. »

In other words, your fees are already deducted for you inside the mutual fund. In addition, your accountant will be pleased to find that it is no longer necessary to indicate the fees on the tax information slips separately. Of course, you will save fees and time on your next tax return.

You are using an integrated account (WRAP) or a separate management account (SMA)

Holders of integrated or separately managed accounts pay their fees directly. You are the direct owner of the underlying assets, so you must report the gross income from your funds annually. This nuance is essential because it allows you to deduct the fees charged to your accounts as an expense.

In short, the investor’s net after-tax income will be identical whether you choose an investment trust, corporate class, an integrated account, or a separate management account.

Are there any tax advantages to choosing one account over another?

At first glance, there are several factors to consider, so it is a personal decision that will be made with your investment advisor. Undeniably, whether you choose a mutual fund or mutual funds within a corporate class structure, these are the most appropriate investment vehicles for most Canadian investors.

Finally, according to Ghislain Maillet, District Vice-President at Fidelity: « Fees are one of the biggest myths in the financial services industry. The reality is that investors have a choice: they can deduct all management fees directly or indirectly. Mutual funds are incorporated into trusts or corporations. In both cases, the fees are deducted at source (indirectly) before the net taxable distributions are passed on to investors. On the other hand, funds incorporated as corporations (class funds) offer real tax advantages such as converting foreign interest income and dividends towards taxation in the form of a capital gain (50% fewer taxes). »