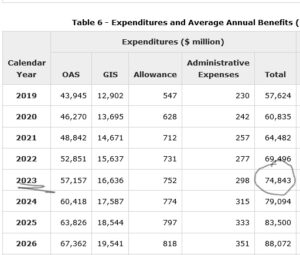

Concerning the 17th Actuarial Report, of the Office of the Superintendent of Financial Institutions (OSFI), there is every reason to believe that the estimated cost of distributing old age pension (OAP) cheque benefits will be $74 B in 2023. As we progress in time, the figures highlighted in the report will blow your mind: a creeping barrage of cost increases culminating at 116% in 20 years.

With that in mind, let’s take a few minutes to get used to the magnitude of these numbers. As eluded, this year, it is estimated that we will cash $ 74 B worth of OAS, GIS/Allowance checks; for comparison purposes, the projected cost of Highway 413 is around $ 10 B; so, it’s like buying the equivalent of 7-8 Highway 413 every year!

More surprisingly, in 20 years, the estimated cost of OAP is $ 161 B. In all these dimensions, the problem lies in the fact that our taxes pay for OAPs, so their net costs are a current federal government expense. In other words, we must pay the full spectrum of this bill without any contributory aid from our fellow citizens.

Moreover, starting from this premise, waiting 20 years before seeing the upward spiral of costs is unnecessary. In the same OSFI report, actuaries concluded that there would be a projected expenditure increase of 117% between the 2022 and 2023 years, a projected expenditure increase of $ 12.7 B for the period between 2022 and 2026, finally; The number of beneficiaries utilizing OAP will increase quite markedly.

By this very fact, the cause of the meteoric acceleration of this expenditure is, invariably, the change in our society’s demographic landscape. With that in mind, let’s immediately fix one thing with OAPs: their sustainability; their survival is at stake. But, above all, it is unlikely that we can improve and amend the program for future generations.

As per Statistics Canada website; on a webpage called population projections for Canada (2021 to 2068), we don’t need an in-depth demonstration of analysis to figure out that as our population grows, so will the need for OAP check benefits. Indeed, these stats aren’t meant to be projections; however, where there is smoke, you know the rest…

Case-in-point: glance at the age structure of the Canadian population; it is unequivocal. The population growth of Canadians aged 65 years and older will accelerate rapidly. The Baby Boom Generation will transition to, what I call, the Retirement Boom Generation. It is estimated that by 2030, in 7 years to be precise, the proportion of the total population aged 65 years and over will increase by an average of 22%. So, naturally, this will further exacerbate OAP costs and may lead to necessary tax increases for the sole purpose of the program’s sustainability.

We have been discussing the viability of OAPs for years, years, and years. But, as indicated, we may, this time, be at an inflection point. As you know, silly season is every 3-5 years; therefore, politicians will naturally try to kick this one down the road.