Class warfare, which is as old as humanity, can prompt specific individuals to question the legitimacy of some of the fiscal tax advantages granted by our legislators. On this principle, the tax derogatory mechanism of the preferential treatment of capital gains (from now on, « PTCG ») is highly politicized because it involves an important social justice issue for our society.

Before even considering changing the parameters related to the tax expenditure of the PTCG, it is beneficial to know who will ultimately be affected/targeted by the change in its tax treatment. The people who have benefited from the PTCG last few years aren’t, in large part, the wealthiest in our society.

The target

Think about it for a few minutes; visualize your family and loved ones; I’m reasonably sure that you know people who have initiated, at some point, the following financial transactions:

First, they may have sold a home, afterward, disposed of shares on stock exchanges, then; sold a small business; finally, they may have used the deferral provision for capital gains (from now on, « CG »)

Considering the list of people you just made, is it fair to assume that all your loved ones are wealthy? Indeed. Contrary to popular belief, the longitudinal line of people who benefit from the PTCG is well-defined and balanced among the multiple social classes of our society.

The empirical example we have just made together is grounded and supported by statistics. The authors of the essay entitled « The Real Concentration of Capital Gains in Canada » dissected specific data banks and came to the following conclusion:

« Lower-income taxpayers benefit more than you might think from the PTCG, especially when they are 55 years of age and older[1].» (Underlined added)

Admittedly, taking a step back, it is necessary to go beyond the figures and ask questions. For example, the perception that capital gains favor the wealthiest in our society is linked to a historical statistical compilation problem. In other words, if the issue you want to identify isn’t adequately supported by the tax data compiled, invariably, our conclusions and perceptions will be wrong.

The clustering effect[2]

The starting point of this article is the actual and timely knowledge of the classes of people who benefit, in some way, from the PTCG. Naturally, the aggregation effect falsifies the data analysis, as there is a concentration issue of several sources of income in the highest income classification brackets.

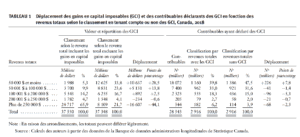

To correctly specify the income classification of the people who are ultimately the users of the PTCG, it is imperative to create two classification categories; one class of people with total incomes that includes taxable capital gains (from now on,« TCG ») and the other, the new classification, subtracts the realization of TCG. This is because the latest statistical classification accounts for the TCG differently; it is embedded directly within the multiple income classes.

First and foremost, we note the concentration effect in the first ranking. Most of the total value of TCG[1] would be concentrated in the highest income class. The reason for the concentration effect in the first ranking is quite simple: when people lock in their TCGs, there is upward mobility in the scale of their total income. People in a specific class make more money, and there is an elevator effect.

In the new classification, when we exclude the realization of TCGs from the classification, there is a significant migration of the value of reported TCGs to the low-income classifications. More specifically, there is an economic trickle, even more so, in the class of people whose total incomes are less than $50,000. As a result, this classification has the highest percentage of the full value of the TCG achieved[2] among the five types of classes.

Table 1: CANADIAN TAX JOURNAL (2021) 69:4, 1193-1212, « The Real Concentration of Capital Gains in Canada », Authors: Tommy Gagné-Dubé, Matis Allali, Luc Godbout and Antoine Genest-Grégoire.

How can we explain this change? It is, among other things, a displacement of several million dollars and several thousand taxpayers to their respective and proper income classes without the clustering effect.

In short, the new classification gives us two key observations: first, low-wage taxpayers also benefit from the PTCG. Subsequently, it is essential to mitigate and nuance the perception that the more affluent taxpayers disproportionately benefit from the PTCG.

[1] CANADIAN TAX JOURNAL (2021) 69:4, 1193-1212, Authors: Tommy Gagné-Dubé, Matis Allali, Luc Godbout and Antoine Genest-Grégoire, p.1194.

[2] Id., p. 1196

[3] Id., p.1200

[4] Id.TABLE 1,p.1198