As you are accustomed to every morning on the bridges, certainly you have noticed a fluid workforce and impressive interprovincial trade mobility between two Canadian cities. Indeed, the city of Gatineau, as well as the city of Ottawa, are, in large part, almost fully integrated economically. The two riverside cities are emblematic of a federal linguistic metaphor that connects two peoples, two cultures, in the same family ecosystem.

Certainly, even though it shares the same ecosystem, your quality of life can invariably differ depending on your province of choice. On the one hand, your quality of life may vary according to your province’s weight and tax burden; on the other, it will also depend on regional differences in real estate prices.

Considering your situation, which city/province can offer you a better quality of life?

Your tax expense

You would be surprised to learn that it is tax-efficient to move to Quebec. That said, according to the Research Chair in Taxation and Public Finance of the University of Sherbrooke: “The fact that the burden of personal income taxes is relatively high in Quebec is not necessarily indicative of families’ disposable income.”

Simply put, the weight of Quebec’s tax measures includes your taxes paid, and your payroll taxes, and we must subtract all benefits received from both levels of government. Quebec is more generous and distributes several benefits, such as the Québec family allowance. This has the effect of reducing the tax burden of certain Québec taxpayers.

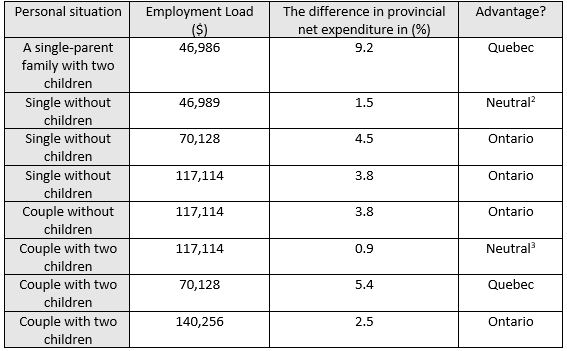

Here is a table summarizing several personal family situations based on your net tax expense. The gap is the differential between the burden of taxes on Canadian individuals.

However, as you have seen, a family’s average wages are relatively low. By broadening the average wage base, let alone making Ontario much more attractive regarding taxation. However, your tax expense is only one factor to consider in your decision-making: you must turn to the most important asset on your balance sheet.

Real estate

The highlight of the show for Québec is real estate. This component is not only important but also responsible, in part, for positive interprovincial immigration in recent years. On this principle, a single-family home in Ottawa costs an average of $606,300; the same house in Gatineau is $451,800. As you realize, the difference is considerable.

According to this same line of fire, a couple who buy this house will have different monthly payments depending on the province of residence. In this sense, the difference in monthly payments is approximately $997.

Of course, the choice of your province must be considered according to several criteria. Similarly, you must consider your family situation, average salary, and real estate preferences. Contrary to popular belief, moving to Quebec can be fiscally advantageous.

The elephant in the room

Québec purists will grind their teeth profusely with my following statement; in theory, you don’t have to learn French; however, in practice, you should be able to converse « en Français ». It would be best if you tried; it’s a question of respect. Consequently, you must remove the spider webs from Miss Culpepper’s « K12 French Books » at Woodroffe high in Ottawa. Remember, as Canadiens, our pluralistic society makes us different from our southern neighbors.

[1] Collective edited by Tommy Gagné-Dubé, Bilan de la fiscale au Québec – Édition 2023 (2023), Cahier de recherche 2023-02, Chaire de recherche en fiscale et en finances publiques, p. 85

[2-3] Table: the neutral position is because the gap is too small. It’s not enough to influence one way or the other.

[4] The mortgage comparison: $70,000 total deposit against mortgage loan; 5 years variable with static payments.