God knows, over the years, writers have poured lots of ink onethics in taxation. Despite this, in all the published information, we appear to have confused, deliberately or inadvertently, the difference between two critical concepts in tax ethics, those relating to tax avoidance & tax evasion.

Primo, the instincts of the human being, resist sharing with others. Sometimes, for some people, their strong sense of ownership – as described by Jean-Pierre Vidal – refrains themfrom fully adhering to the law, consequently preventing themfrom reducing the fair sharing of their taxes with the state. Indeed, some taxpayers will try to manipulate the law favorably with more aggressive/abusive methods, including those related to tax avoidance.

Secondo, fraud-related behavior is tax evasion. These behaviors do not help our society because they violate the advancement of our purpose, which is related to financing our ecosystems of moral and social democratic priorities. Essentially, it creates dislocations and income shortfalls in our society’s budget.

What is tax avoidance?

Canadian tax legislation established the two ethics concepts discussed in this piece. In the case of tax avoidance, it does not involve any fraud or concealment of the facts; there is nothing hidden. It implies that one orders one’s affairs by the letter of the tax law; our goal is to minimize the taxes paid.

However, some tax planning strategies become more challenging to digest in the eyes of the law; when a person is going to create or invent one or more series of operations that conform to a literal or grammatical interpretation of the law but not to the general spirit of the law. The purpose of the series of transactions is to amplify a tax advantage, enabling a new resurgence of tax savings.

The burden of proof is on our tax agencies; they must prove that there has been an overinterpretation of the spirit of the law. If this is the case, they will remove the abusive tax advantage; from the series of transactions that may have been invented to create a tax advantage.

Tax evasion: prison?

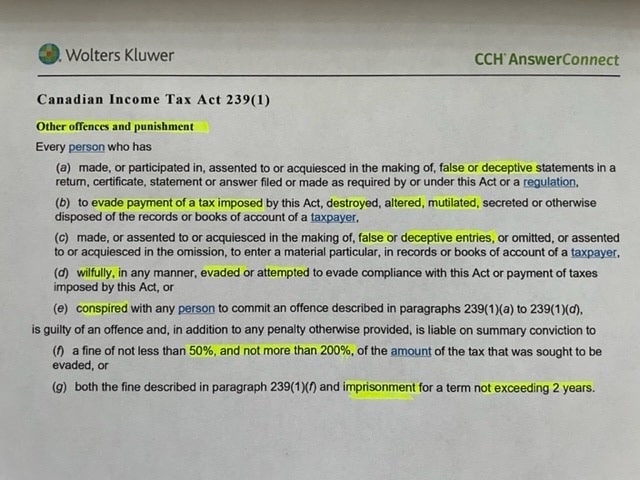

Indeed, it is possible. Consider looking at the language used, by the legislator, in article 239 of the I.T.A. It’s not the language you will find anywhere else in our Canadian tax legislation; it’spowerful! Concerning tax evasion, we are in the criminal law sphere. It involves the concept of mens réa, a guilty, blameworthy spirit, and a deliberate intention not to comply with the law.

Examples of behavior related to tax evasion include and are notlimited to not filing your tax return, not declaring all your income, deducting non-existent expenses, adding personal expenses, falsifying information or documents, etc.

What is the common thread?

Countries that achieve their visions have strong social solidarity; this solidarity is relative, in part, to the acceptance of a balance of conflicting interests and, finally, of citizens who adhere to a fiscal culture to finance, in part, their society’s projects.

What constitutes the substance of this article is the loss of income for the state; the state needs resources to maintain our quality of life and ensure that Canada remains one of the best countries in the world.